Protection for Traders & Risk Managers to Tackle Market Complexities

Risk Management is a key pillar to servicing the industry. Unlike other firms, we want our clients to take risk management as seriously as we do.

That is why we offer our in-house risk solution Eagle to the market, so that they can monitor their risk like the #1 liquidity provider. Eagle is a precise real-time commodity trading and risk management solution, ensuring that risk managers stay in complete control. It allows them to navigate market volatility by setting active risk controls, all whilst meeting every regulatory and compliance framework required in oil markets.

With Eagle, clients can expect enhanced operational efficiency and an unparalleled view into their exposure, tick by tick.

A Real-time Solution Designed for Commodity Trading & Risk Management

Request Your Eagle Trial

Seamless Integration

Trade FIX adaptors for ICE, CME, EEX, clearing bank parsers for reconciliation, native connectors to Flux, ICE Data Services for live curves.

Comprehensive Coverage

Provides comprehensive support for commodity derivatives trading, encompassing crude oil, oil products, natural gas, and power markets.

Continuous Risk Monitoring

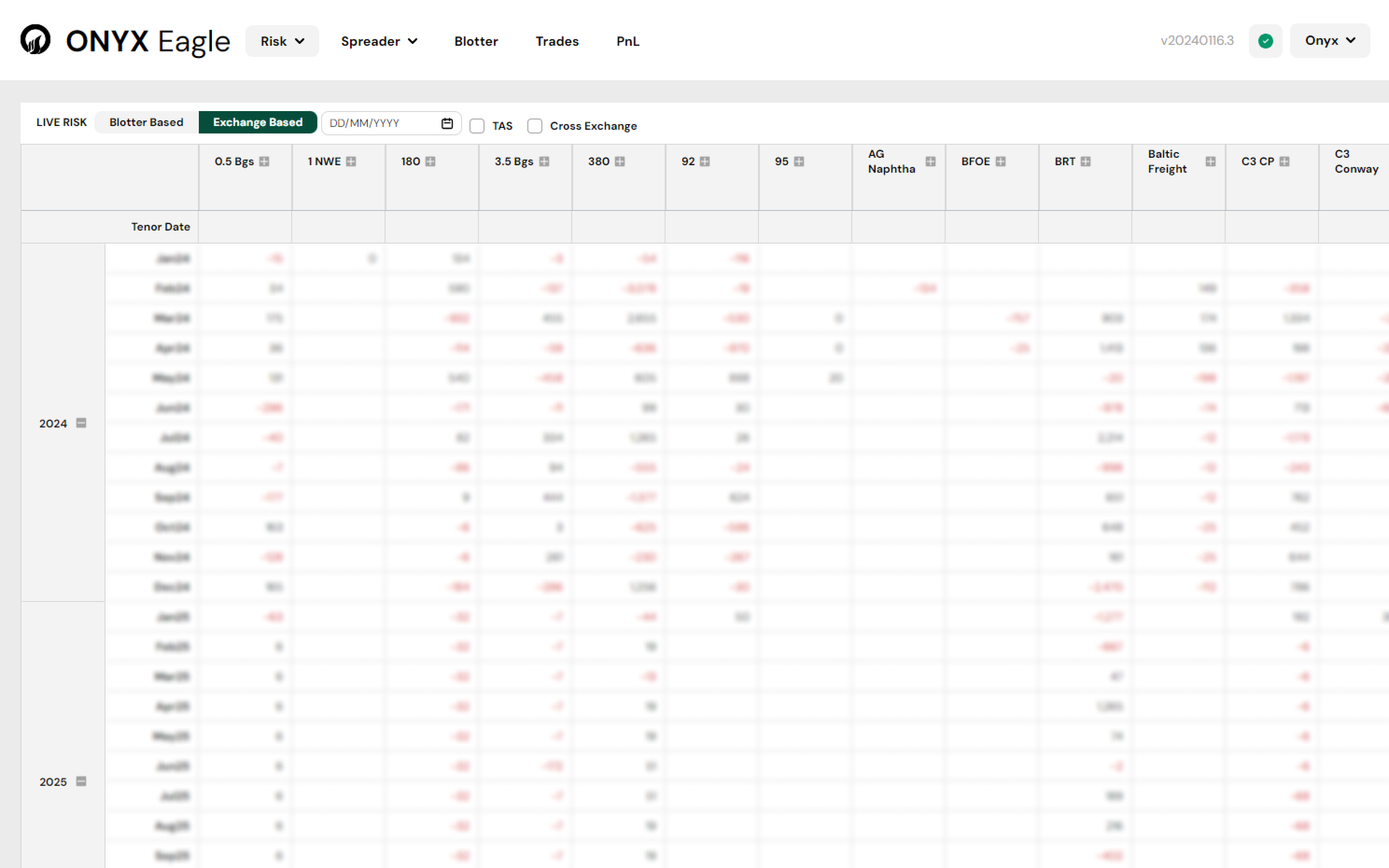

Live position tracking with trade level, account, book, portfolio reporting by instrument and exposure, with real-time MTM P&L, VaR, and intra-day limit alerts.

Efficient Operations

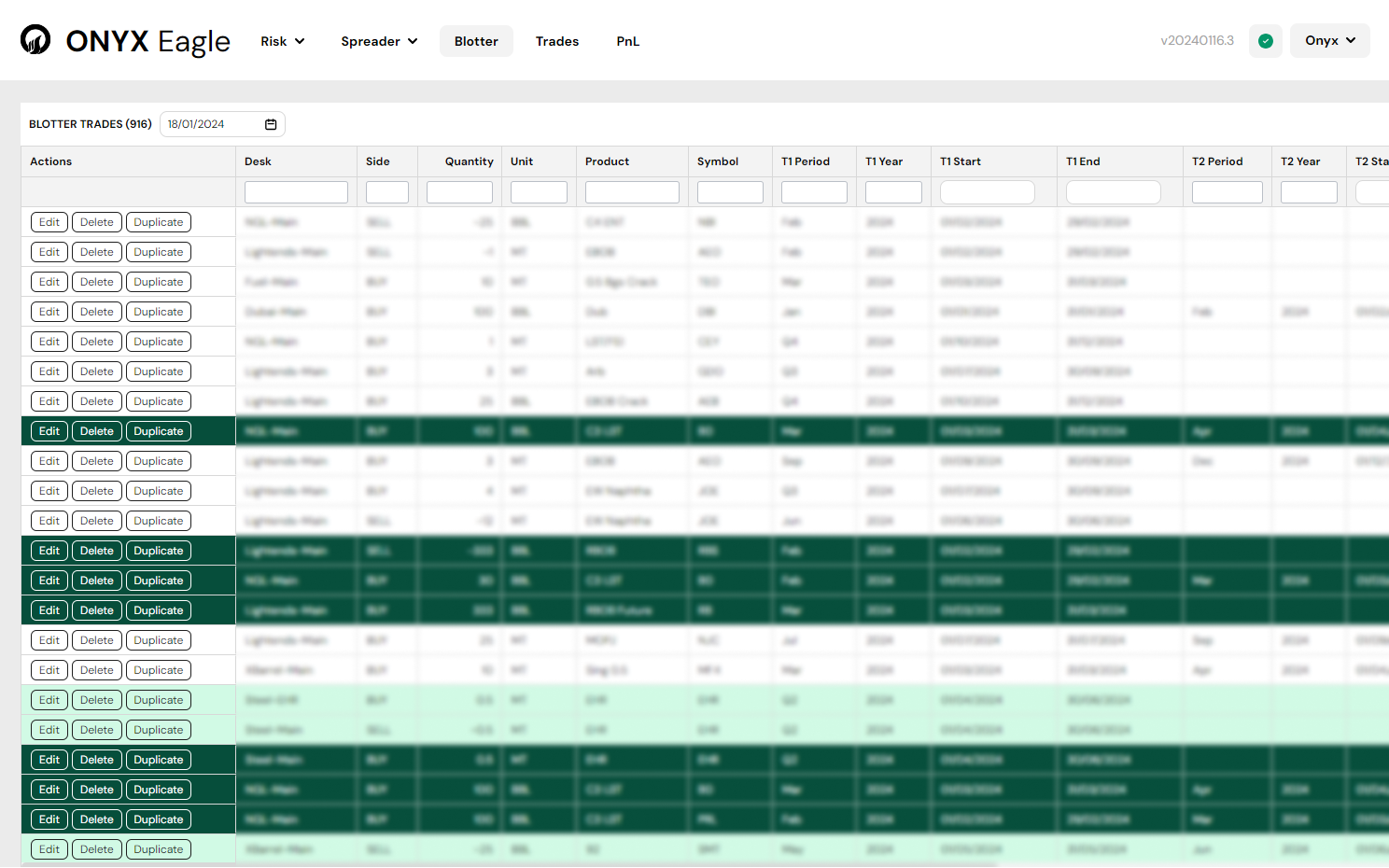

Trade blotter with clearing trade matching and replacement, 3-way trade, position, P&L reconciliations with exchange and clearing bank.

Flexible Deployment

Offers flexible cloud-based deployment options, including multi-tenant SaaS or single-tenant private instance, ensuring scalability, security, and customisation.